Planning a Staged Exit

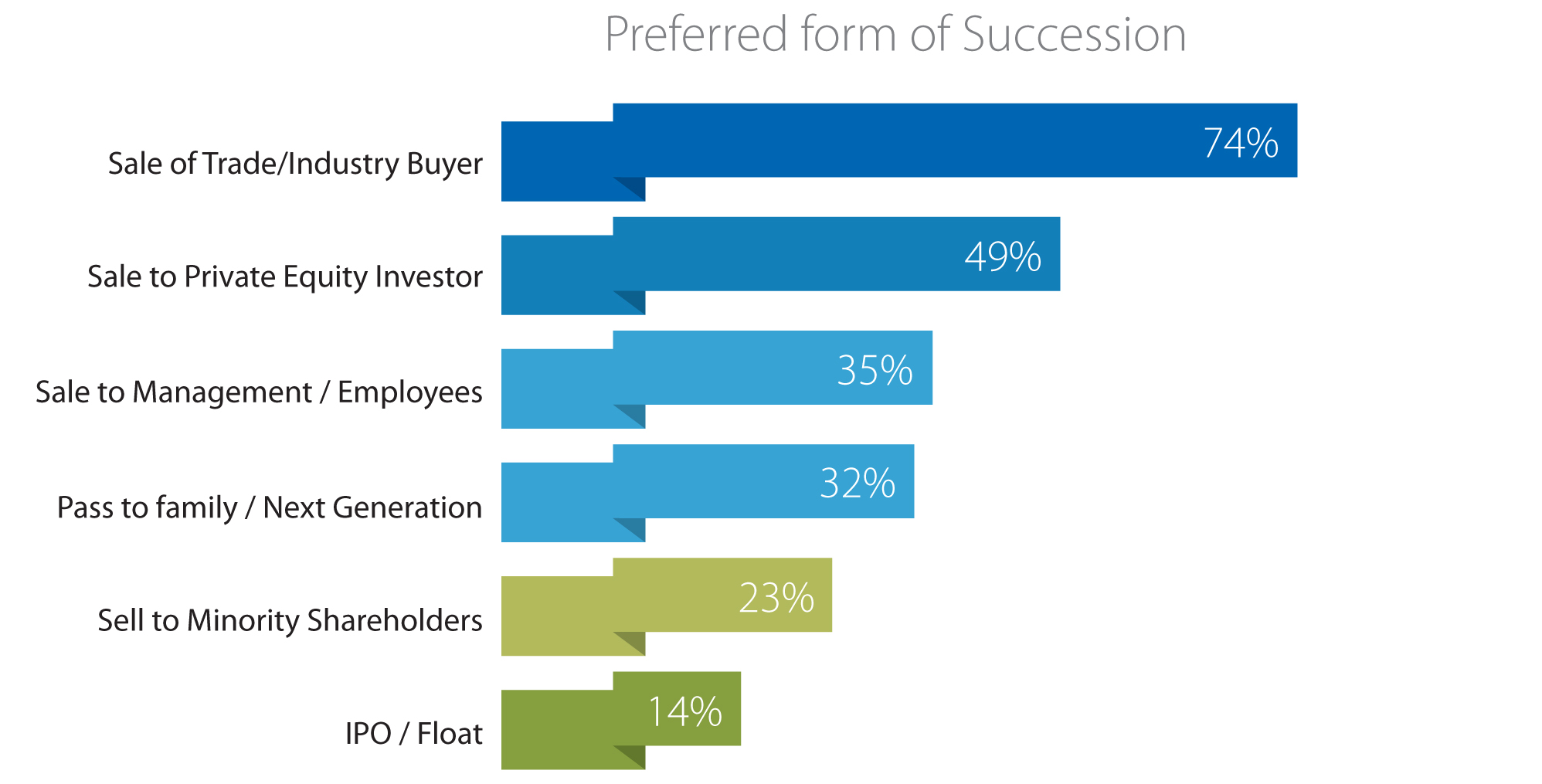

Market research and business owners like you are telling us that when you are planning to exit your business, you want more options than just the all or nothing approaches of:

1. Selling all of your shares for cash upfront (Outright Share Sale); or

2. Selling all of your business assets for cash upfront (Outright Asset Sale).

Is there another way to exit your business, or free up capital and time without going to the extent of an Outright Sale? Is there a third option? Yes.

The third option some business owners are asking for is a Staged Exit from their business. A Staged Exit often ultimately leads to a complete exit from your business, but it is also possible for you to partially exit your business and retain a financial interest and/or working involvement in your business indefinitely.

In other words you can free up both capital and time, continue to be involved in the business in whatever capacity you desire, and share in the future potential of your business.

There are many different options for achieving a Staged Exit and each gives rise to different issues. We have assembled a team of leading experts in law, accounting/finance and banking/capital solutions to help outline your options, explain how to resolve any issues that might arise and to help you achieve a successful Staged Exit. This document explains the concept and provides a high level summary of your options.

What are my options for achieving a Staged Exit from my business?

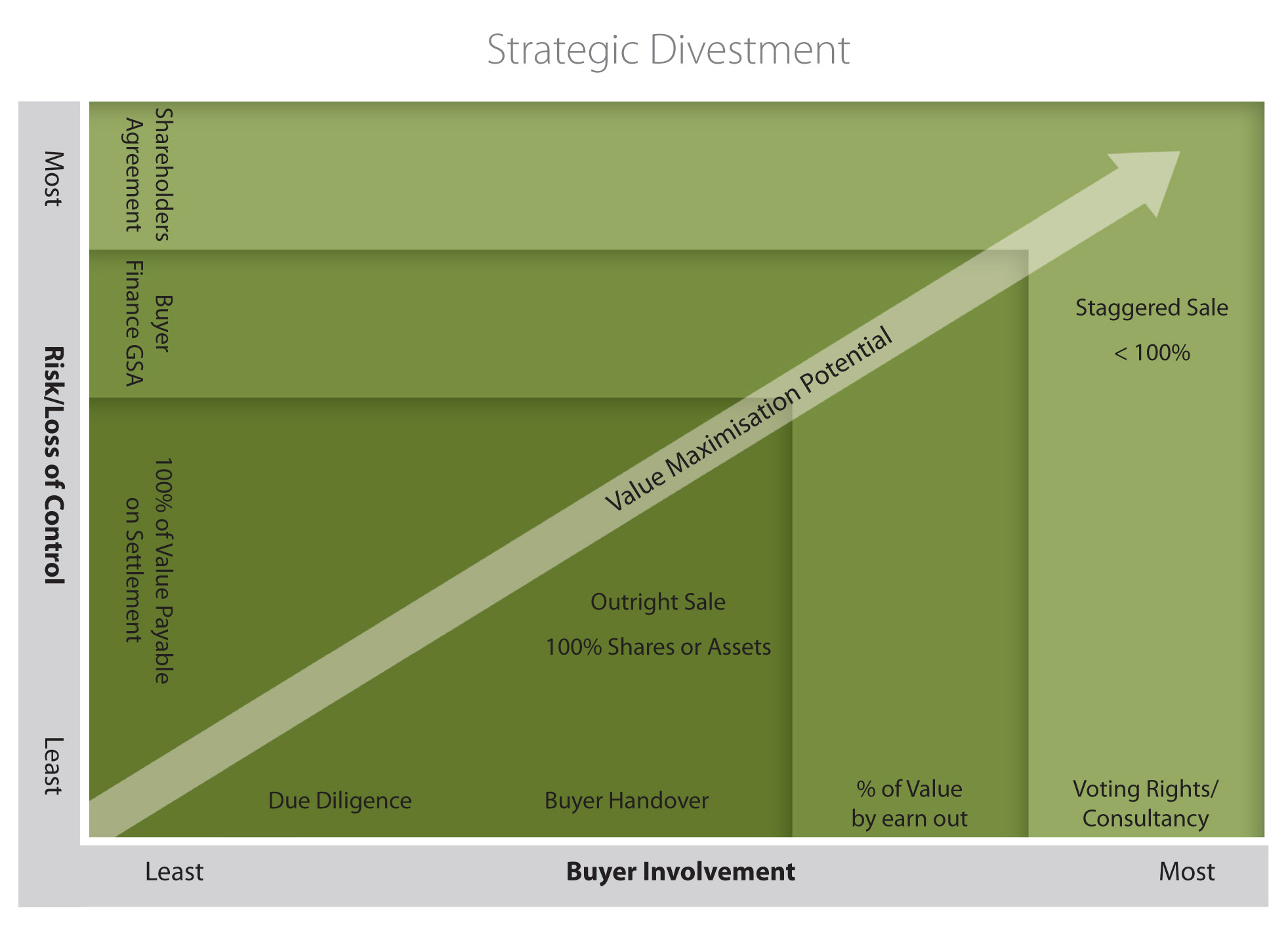

The options for achieving a Staged Exit are endless, limited only by the imagination of those structuring the deal. However, the majority of these options can be grouped into two main types of transactions.

- Staged Sale – Sell part of your business now and sell part(s) later and get paid in instalments for each part as it is sold. Typically this is done by selling shares, but it can be done by asset sale if the business assets are capable of being sold in parts.

- Vendor Financed Sale – Sell all of your business now and get paid in instalments over time. This can be done by either selling the business assets or shares.

Staged Sale

A Staged Sale involves selling part of your business now and part(s) later and getting paid in instalments for each part as it is sold. If you want to retain an ownership interest and involvement in your business indefinitely, the following comments on Staged Sales still apply, with the obvious difference being that you do not sell all of your business.

There are various reasons why you might choose a Staged Sale, including the following:

[checklist]

- The buyer may not have enough money to pay the full purchase price for 100% of the business now.

- You may want to retain an ownership interest in the business for a period (or perhaps indefinitely) and share in the upside of the business following the sale of the first part of the business. The purchase price formula can be designed so that any subsequent payments would increase to reflect business growth and result in a greater total purchase price than would have been paid in the context of an Outright Sale.

- By selling part of your business, you can free up some capital for other things.

- Often the introduction of the buyer as your business partner allows you to transition out of a hands-on management role to a less involved role as, say, a director, consultant or investor and free up your time for other things whilst minimising disruption to the business.

- You may want to retain a certain level of control over the business following the sale of part of your business and keeping an ownership interest entitles you to some level of control.

[/checklist]

Two key risk management issues which arise in the context of a Staged Sale which do not arise (or are less important) in the context of an Outright Sale are Control and Enforcement / Security.

[checklist]

- Control – As you transition from being a 100% owner of your business to a part owner and perhaps ultimately to exiting altogether, you need to consider what level of control and input you want to have in the business and what level of control and input you want the buyer (your new business partner) to have. It is also important to consider from a buyer’s perspective what level of input and control the buyer will want. A buyer may be put off if their level of input and control does not match their investment.

We know that it can be hard to loosen your grip on the reins, but there are many ways to share control with a buyer without relinquishing control altogether. Issues of control can be agreed and documented in a number of ways and together with your legal advisers LINK can help you choose the best way to maintain your desired level of control.

- Enforcement / Security – Because you would not complete the sale and receive all of the purchase price upfront, you need to think about what should happen if the buyer fails to complete any future steps or make any future payments. There are a number of ways to ensure this is done. We note below just three examples of how you might protect yourself against buyer default, but together with our team of expert advisers, we can help tailor the best way for you to do this depending on your circumstances.

- Buy Back Right – If the buyer defaults you could have the right to buy the buyer’s share of the business at a pre-agreed price and take back full control and ownership of the business.

- Security – You could take a security over the buyer’s assets and if the buyer defaults you could exercise your rights under that security to sell those assets in order to recover the balance of the price and complete the sale.

- Control – You could agree with the buyer that the buyer’s control right inrespect of the business are suspended for so long as the buyer is in default.

[/checklist]

Vendor Financed Sale

A Vendor Financed Sale often involves selling all of your business now and getting paid in instalments over time.

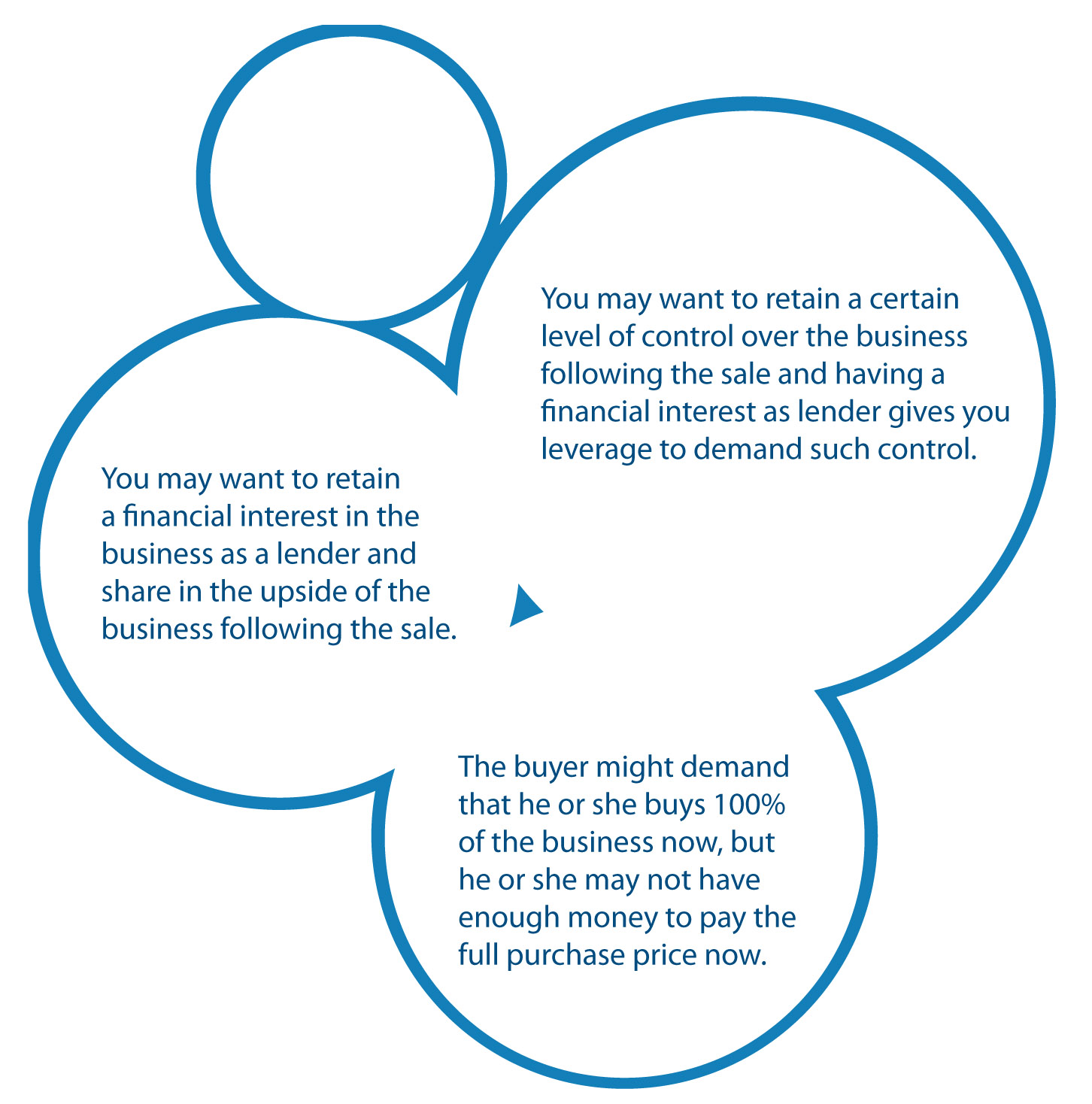

These are some of the reasons why you might choose a Vendor Financed Sale;

[checklist]

- The buyer might demand that he or she buys 100% of the business now, but he or she may not have enough money to pay the full purchase price now.

- You may want to retain a financial interest in the business as a lender and share in the upside of the business following the sale.

- You may want to retain a certain level of control over the business following the sale and having a financial interest as lender gives you leverage to demand such control.

[/checklist]

The similar risk management issues of Control and Enforcement/Security are also important in a Vendor Financed Sale.

[checklist]

- Control – Until you are paid the full purchase price, even though you do not have an ownership interest in the business, you need to consider what level of control and input you want to have in the business in order to protect your remaining investment. Unlike the situation of a Staged Sale where you retain ownership rights, in a Vendor Financed Sale you do not have an ownership interest in the business to justify having control over the business. You need to find a different way to achieve this control. Again, issues of control can be agreed and documented in a number of ways and together with our team of expert advisers we can help you choose the best way to maintain your desired level of control.

- Enforcement / Security – Because you do not receive all of the purchase price upfront in a Vendor Financed

- Sale, you need to think about what should happen if the buyer fails to complete the purchase in the future.

- Similar protection mechanisms can be adopted to those noted above in relation to Staged Sales. Using those same examples of protection mechanisms as above, the key differences from a Staged Sale include the following:

- Buy Back Right – A buy back right may be less appropriate in this context, as the buyer would be the 100% owner of the business, compared to a part owner of the business in the context of a Staged Sale.

- Security – Taking a security is more important in the context of a Vendor Financed Sale, as you would have tranxamples of common types of buyers and some common attributes of such buyers.

[checklist]

- Trade Buyers – Trade buyers often look for synergies with their own business which may justify a premium price, but care needs to be taken to carefully pre-qualify such buyers (especially competitors of the business) and protect your confidential information.

- Financial Buyers – Financial buyers often have a fixed term focus and are looking to minimise financial risk and maximise return on investment. They often use a variety of financing options to balance their risk / return profile. As they will probably not be actively involved in management, financial buyers typically focus on the quality of management and often want to incentivise management to stay and perform.

- Family – Often business owners are concerned that family members cannot afford to buy them out, or do not want to buy them out, or are not capable of running the business. There is no easy answer to the relationship issues that arise, but creative deal structuring can mitigate some risks and financing options can often overcome a lack of financial resources.

- Management / Business Partners – Similar to family buyers, many business owners are concerned that management cannot afford to buy them out, even though management are often considered to be a preferred buyer. Management buy outs (MBO’s) often involve creative financing options to make up for management’s lack of financial resources. Management buy outs or sales to fellow shareholders can often be easier to complete due to the buyer’s existing knowledge of the business, but they also give rise to other unique issues such as potential conflicts of interest.

[/checklist]

LINK maintains a large database of qualified buyers seeking businesses in all sectors and your LINK Corporate

Broker is experienced in helping identify and pre-qualify the right buyer for your business. Working together with your advisers and your bank, LINK can also structure any sale to suit the unique needs of different buyers.

(highlighted text box) Despite the increasing demand for Strategic Exits, Outright Sales are still the preferred option for many business owners who want a complete exit from their business in a shorter period of time. Ask your LINK Corporate Broker if you want more information about Outright Sales, an area of absolute expertise for the LINK team who have sold hundreds of SME businesses outright.

What are the options for financing my exit and how does this affect my exit options?

In a situation where both you and the buyer want an Outright Sale and the buyer has significant financial resources to complete the purchase, traditional bank financing solutions are usually sufficient. However, if you want a staggered exit, or if the buyer has limited financial resources, or if any party wants to use alternative financing sources for any reason, there are a number of other financing options both you and the buyer should consider.

LINK together with input from its expert partners can help you choose and implement the financing structure that works for you and the buyer. We summarise below some key financing options which can be tailored and combined depending on the needs of you and the buyer, the size (and value) of your business, the financial resources of the buyer and the type of transaction being contemplated.

[checklist]

- Bank Debt – Bank debt consists of traditional bank loans and facilities. Bank debt is often secured against the assets and/or shares of the business and ranks first in priority. Because this debt is often first ranking and secured, the interest rate payable is low relative to other forms of debt.

- Mezzanine Debt – Mezzanine debt is often subordinated (i.e. it ranks in priority behind other debt) and unsecured lending. Because this debt is often subordinated and unsecured, the interest rate is usually higher than bank debt interest rates.

- Hybrid Securities – A hybrid security is a type of security which has elements of both debt and equity. Examples include convertible notes and redeemable preference shares. Common characteristics include set dividend/interest rates and an ability to convert into another type of security on certain events occurring. Hybrid securities allow investors to balance risk and return and are typically used by financial investors in conjunction with other financing options.

- Vendor Equity (See Staged Sale) – Vendor equity is where you sell some of the shares in the business, but also retain some shares.

- Private Equity (See Financial Buyers) – Private equity in this context means where a financial investor buys shares in your business, usually for a fixed term. The financial investor will look to add value via their expertise in investing in and governing similar businesses to maximise growth and then exit at a profit. Financial investors often require other forms of debt and equity to optimise the capital structure.

- Management Equity – Management equity is provided by management investing in the business. Often management do not have sufficient equity to complete a purchase alone, and so management equity is often combined with other forms of debt or equity.

- Vendor Debt (See Vendor Financed Sale) – Often referred to as ‘Vendor Finance’ or ‘leaving money in’, vendor debt arises when you sell your business, but don’t get paid the full purchase price until some point in the future. Interest on vendor debt is often similar to bank rates, but if it is secured, it typically ranks second behind bank debt.

[/checklist]

When you are planning to exit your business, there are more options available to you than an Outright Share Sale or an Outright Asset Sale. Your LINK Corporate Broker together with leading experts can help you work through the options, identify potential buyers, structure the financing options and ultimately identify and implement an exit strategy that works for you and your business.